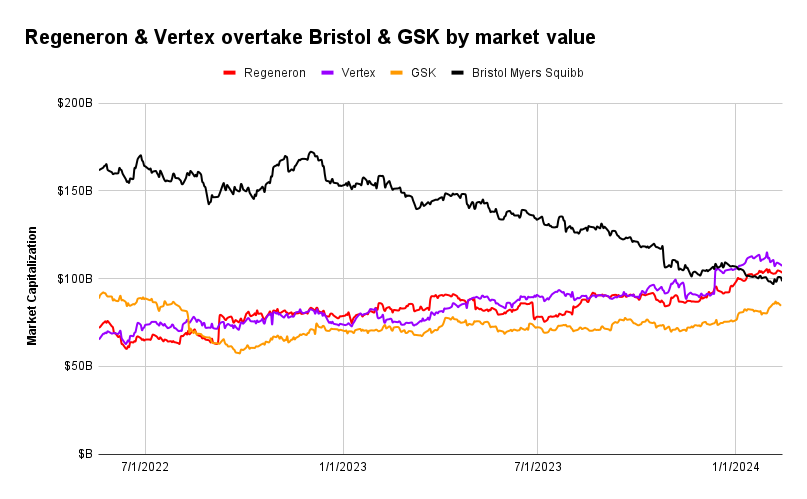

For the first time, Regeneron and Vertex have crossed the $100 billion market cap threshold. They join about 15 other drugmakers that count as the industry’s biggest, and include other giants like Johnson & Johnson, Merck, and Novartis.

And while it’s an arbitrary line, it’s also a signal of how the industry is evolving — both companies are biotechs that have spent years building their R&D identities with a sharper scientific focus and far less dealmaking than typically seen in pharma boardrooms. It’s a sign that new approaches to M&A, R&D and leadership strategies are shaping the future of pharma, and how the newest giants have been built differently.

Both companies are now worth more than longtime bellwethers GSK and Bristol Myers Squibb. Bristol Myers slipped below the $100 billion mark when it reported earnings on Feb. 2, the first time it has fallen out of the $100 billion club since 2019, according to historical market data provided by AlphaSense.

While many older members of the $100 billion club have been doing large, late-stage deals, the newest inductees rarely do.

Vertex and Regeneron have bought biotechs on the relative cheap to bring in long-term science, rather than targeting near-term revenue, such as Vertex’s $950 million acquisition of Semma Therapeutics in 2019 around its diabetes cell therapy research, or Regeneron scooping up the gene therapy biotech Decibel Therapeutics last year for $109 million.

Both have favored R&D partnerships over outright acquisitions. Vertex’s collaboration with CRISPR Therapeutics has now yielded the first approval for a CRISPR-based drug. Regeneron, too, has linked up on R&D with Intellia Therapeutics on CRISPR and Alnylam on RNAi.

And one school of analysis argues that, across industries, the majority of M&A destroys shareholder value. Drug industry analysts like Mizuho healthcare sector specialist Jared Holz agree.

“For a lot of the deals in biotech, the return profile is not all that good,” Holz said. “A lot of the deals are done out of necessity as much as out of pure interest.”

Bristol Myers became a megadeal poster child through its 2019 acquisition of Celgene. The $74 billion deal was driven by need, analysts said at the time, as both companies struggled with challenges in maintaining growth.

The Celgene deal “helped maintain earnings for a while, but now we’re at the point where that’s going to evaporate,” Holz said, adding that new generic competition to Celgene’s best-selling Revlimid is now Bristol’s problem.

Those needs haven’t gone away, however. New CEO Chris Boerner is pitching investors on a future beyond a massive patent cliff with its drugs Opdivo and Eliquis. The New Jersey pharma ended 2023 by agreeing to acquire Karuna Therapeutics for $14 billion and RayzeBio for $4.1 billion. Bristol’s stock has fallen about 5% since those deals were announced, and is down 30% over the last year, while the NYSE Arca Pharmaceutical Index is up 24% in that time.

Tim Opler, a managing director at Stifel’s global healthcare group, said multiple pharmas will typically bid up the price of products to the point where there’s no profitability.

“On average, late-stage, large-scale M&A is not creating value in our industry,” Opler told Endpoints. “And so just because you have a hole in your pipeline in 2028 doesn’t necessarily mean that the right answer is to go out and spend billions buying a Phase III product.”

Long-termers at the top

GSK’s major deal of 2015, a $20 billion asset swap with Novartis, was one of the last defining moves of Andrew Witty’s CEO tenure. It put the company deep into consumer health while divesting its oncology business.

When Emma Walmsley became CEO in 2017, she again named oncology an early priority. Hal Barron joined as R&D head in 2018 to lead that effort. Walmsley has also led a spinout of its consumer health business to solely focus on pharma.

Those ultimately may be the right moves, but Barron left in 2022 after four years to run the richly-funded startup Altos Labs.

Regeneron and Vertex, on the other hand, have “much more entrepreneurial, tech-like” structures, Holz said. “They know exactly what direction they’re going,” he added.

That’s in part because their leaders, Len Schleifer and George Yancopoulos, have been Regeneron’s CEO-CSO duo for 35 years and counting. Vertex has enjoyed a smooth handoff after eight years under Jeffrey Leiden to its current CEO, Reshma Kewalramani. CSO David Altshuler remains in his role overseeing its R&D strategy for nine years — long enough to see R&D bets bear fruit.

Under different leadership, Regeneron could have struck a range of tuck-in ophthalmology deals to build an eye franchise beyond its blockbuster Eylea, Holz said, ticking off names like EyePoint Pharmaceuticals, 4D Molecular Therapeutics, and Adverum Biotechnologies.

“They’ve stood still,” he said, based on their belief in their strategy and internal research to deliver. “Part of it is a little bit of ego as well, but it’s not unfounded.”

It would be a mistake to write off GSK or Bristol Myers — recent alumni of the $100 billion club are too big and too well-resourced.

Take Eli Lilly. In the late 2000s and early 2010s, it was one of pharma’s least-loved names as it suffered through a patent cliff, research struggles, and legal battles. Its market cap fell to just over $30 billion.

A decade later, it’s in a class with an entirely different level of exclusivity — the $700 billion club.

Check out our AAV CDMO service to expedite your gene therapy research

PackGene Biotech is a world-leading CRO and CDMO, excelling in AAV vectors, mRNA, plasmid DNA, and lentiviral vector solutions. Our comprehensive offerings span from vector design and construction to AAV, lentivirus, and mRNA services. With a sharp focus on early-stage drug discovery, preclinical development, and cell and gene therapy trials, we deliver cost-effective, dependable, and scalable production solutions. Leveraging our groundbreaking π-alpha 293 AAV high-yield platform, we amplify AAV production by up to 10-fold, yielding up to 1e+17vg per batch to meet diverse commercial and clinical project needs. Moreover, our tailored mRNA and LNP products and services cater to every stage of drug and vaccine development, from research to GMP production, providing a seamless, end-to-end solution.

Related News

Preclinical Studies Highlight Novel Gene Therapy for IgA Nephropathy Treatment

San Diego, CA – October 28, 2024 At the recent ASN Kidney Week 2024 (October 23–27), researchers presented promising preclinical data on PS-002, an innovative gene therapy aimed at treating IgA nephropathy (IgAN), an autoimmune kidney disease. The therapy, developed...

[2024/10/25] Gene and Cell Therapy- weekly digest from PackGene

FeaturedNewsArticlesPackGene's NewsletterReceive the latest news and insights to your inbox.About PackGenePackGene Biotech is a world-leading CRO and CDMO, excelling in AAV vectors, mRNA, plasmid DNA, and lentiviral vector solutions. Our comprehensive offerings span...

Lipin1 Inhibition Enhances Axon Regeneration: A Potential Therapeutic Approach for Spinal Cord Injury

Traumatic injuries to the central nervous system (CNS) often result in permanent functional deficits due to the limited capacity of CNS neurons to regenerate. Although advancements in spinal cord injury (SCI) research have been made, achieving substantial nerve fiber...

CRISPR therapy reduces swelling attacks by 81% in Intellia follow-up study

The promise of a one-and-done CRISPR infusion is beginning to look more real than ever. On Thursday, Intellia Therapeutics announced that an experimental gene editing therapy reduced dangerous and unpredictable swelling attacks caused by the disease hereditary...

Related Services